Truth About Taxes – Not Everyone is Paying Their Fair Share!

We’ve all received our updated real estate tax assessments for next year, and if you are anything like the average Suffolk resident, yours went up about 6%, again. This week, City Council is going to have a public hearing on the Proposed Fiscal Year 2025-2026 Citywide effective real estate tax increase. The public hearing will be held in the City Council chamber at 6pm, Wednesday, May 7th at City Hall.

Before you make a decision on whether you want to speak or not during the public hearing, read on to find out how Suffolk residents are paying more than their fair share while large corporations, developers, and other businesses are getting a sweet deal with their tax assessments.

Below are just a dozen examples. We looked at hundreds of properties with these issues, and it was by no means an exhaustive search. This is definitely a prevalent problem of businesses being assessed below fair market value, for years in some cases. These combined assessments are worth hundreds of millions of dollars, if not billions, which translates into tens of millions of dollars of lost revenue over the years. We are talking about enough money to build one of the new schools we so desperately need.

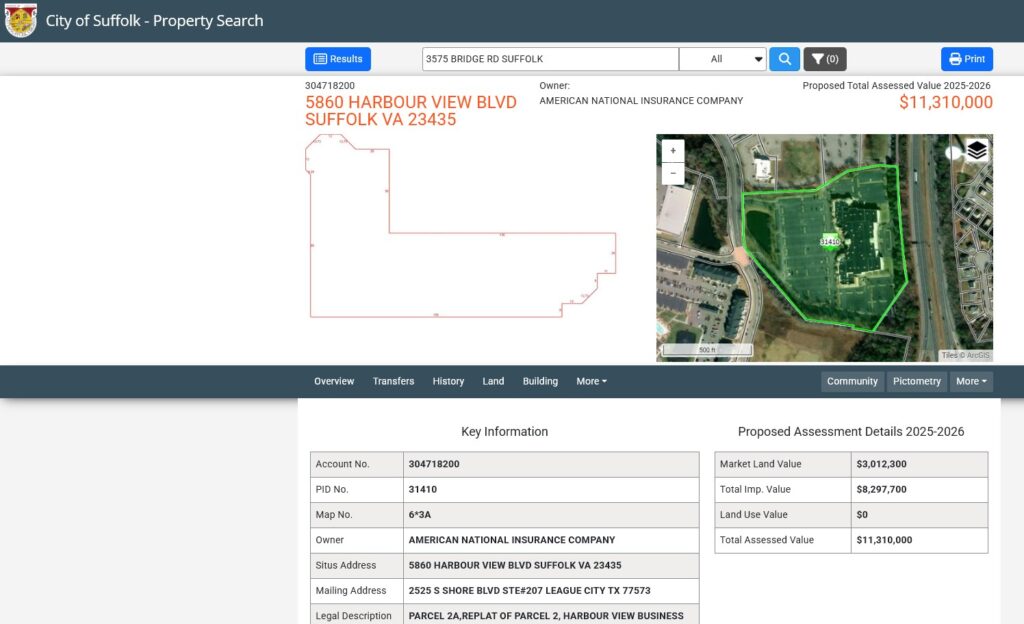

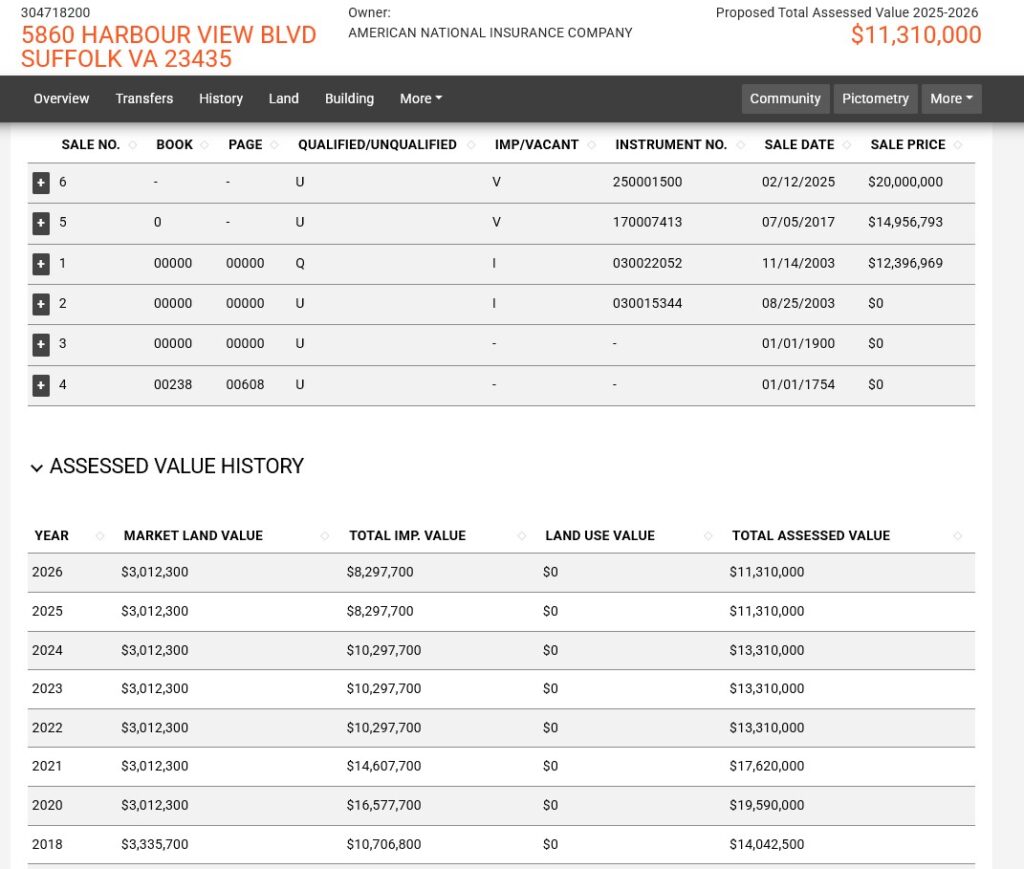

5860 Harbour View Blvd (home of Regal Theater)

This property has been sold multiple times: $12.4M (2003), $15M (2017), and $20M (2025). Its total assessed value has been $11.3M (2025 & 2026) and $13.3M (2022-2024), down from $17.6M (2021). Its market value land assessment (for the land portion only, without including any building or structure) has maintained at just over $3M since 2020, despite being in the epicenter of growth in North Suffolk.

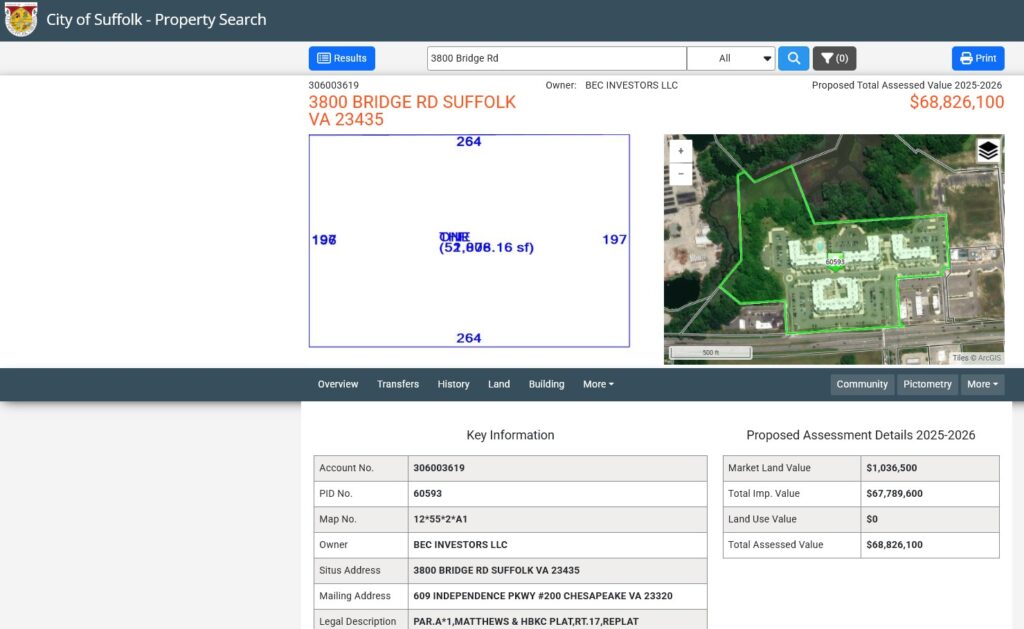

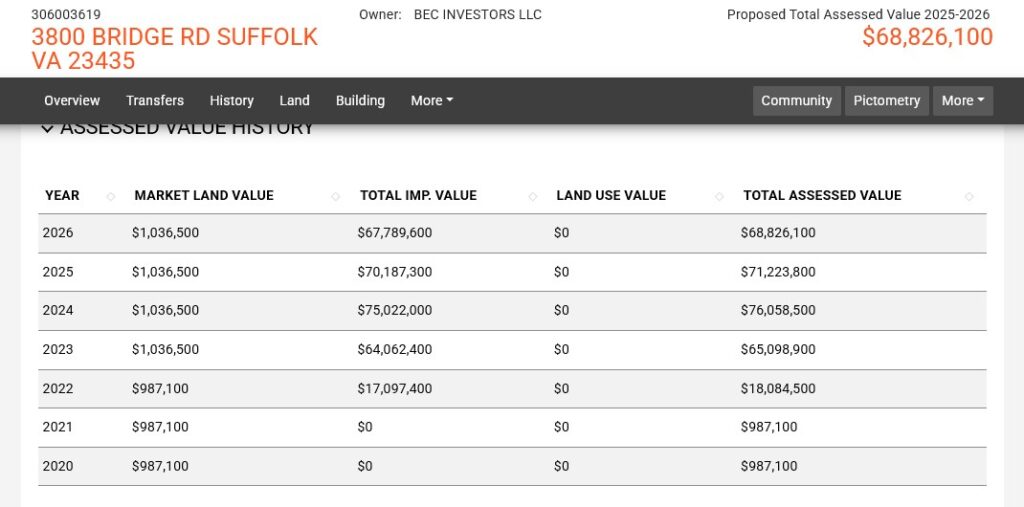

3800 Bridge Road (Bridgeport)

Assessed at $68.8M (2026), this property is almost $3M less than the $71.2M (2025) assessment, and $7.2M down from $76M (2024). This busy mixed-use development, called Bridgeport, contains apartment buildings along with commercial space. Its taxes have been going down, despite its prime location on Bridge Rd in North Suffolk. Though its overall taxes have gone down, the assessed land market value for its 20.25 acres has maintained a $1,036,500 land value for 4 years at a rate of $51,185/acre. The vacant lot across the street, 3803 Bridge Rd (20.1 acres) has a land value of about $2.5M, a rate of $125,914/acres. Bridgeport is getting a real bargain!

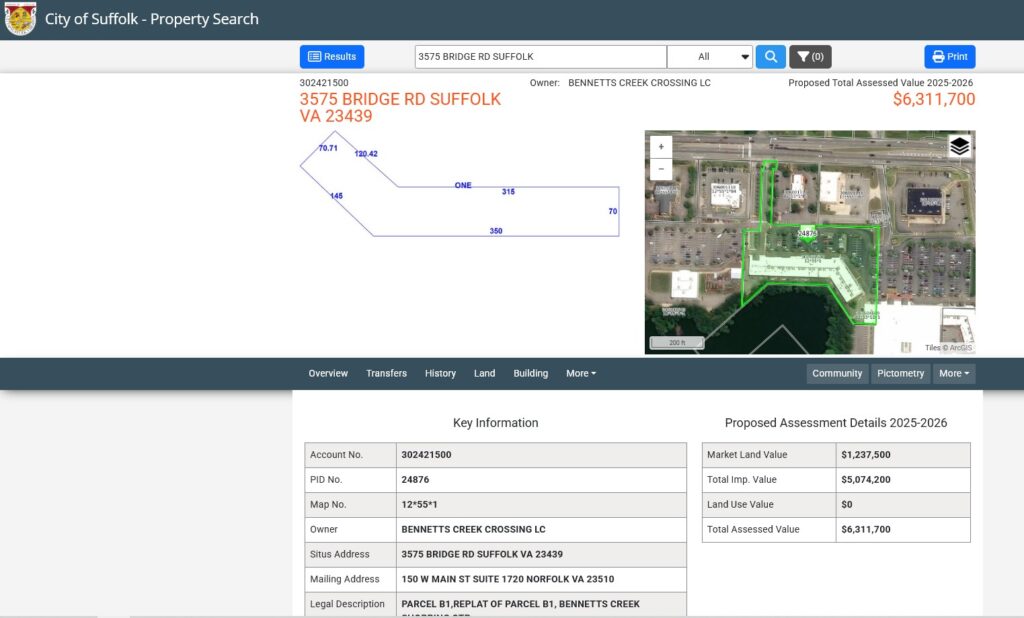

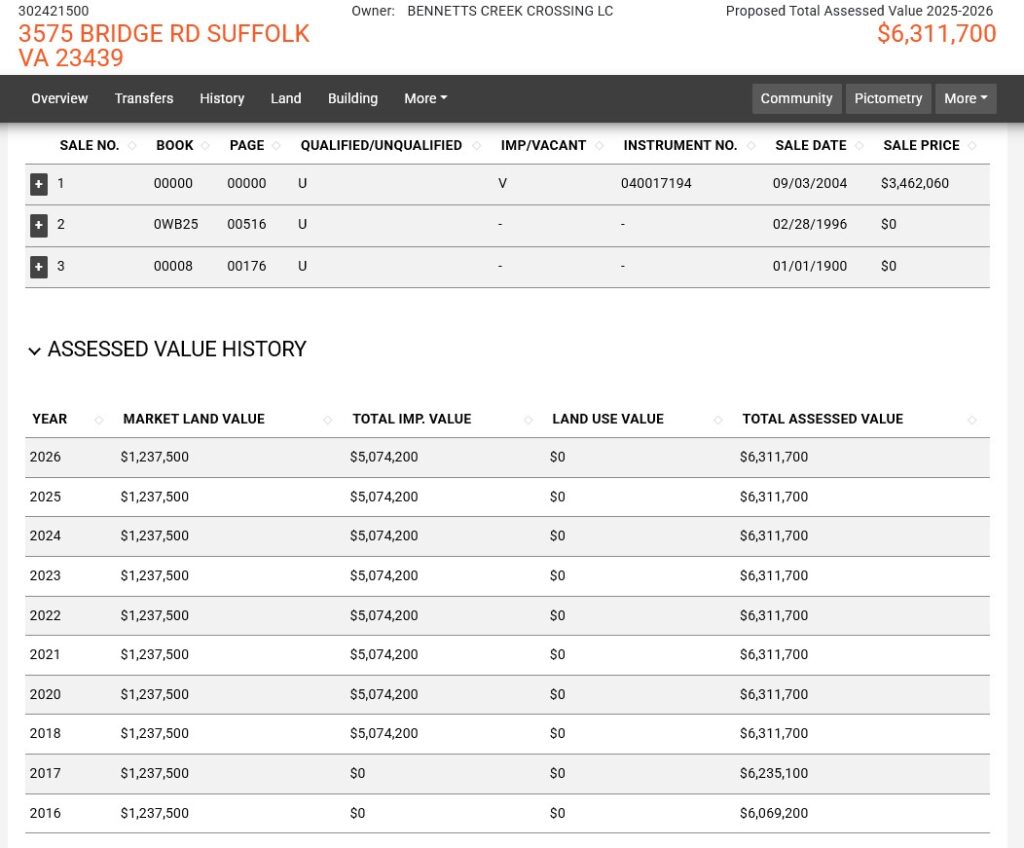

3575 Bridge Rd (Bennetts Creek Crossing)

This is the shopping center located in the same plaza as, and just to the west of, Harris Teeter. It has a total assessment of $6.3M, with the land value assessed at $1.2M. Neither value has gone up in 8 years!

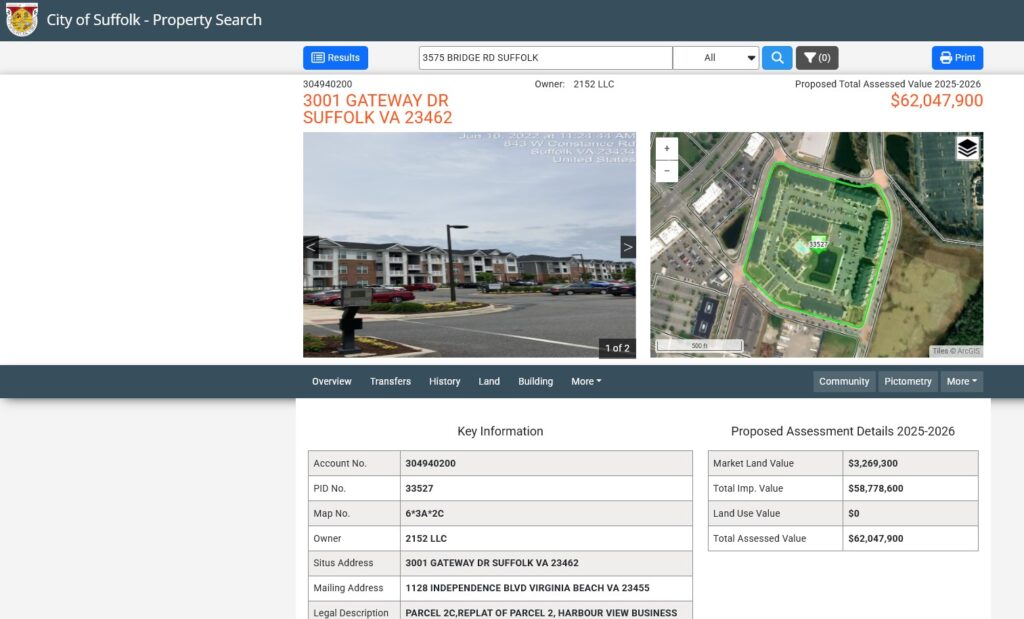

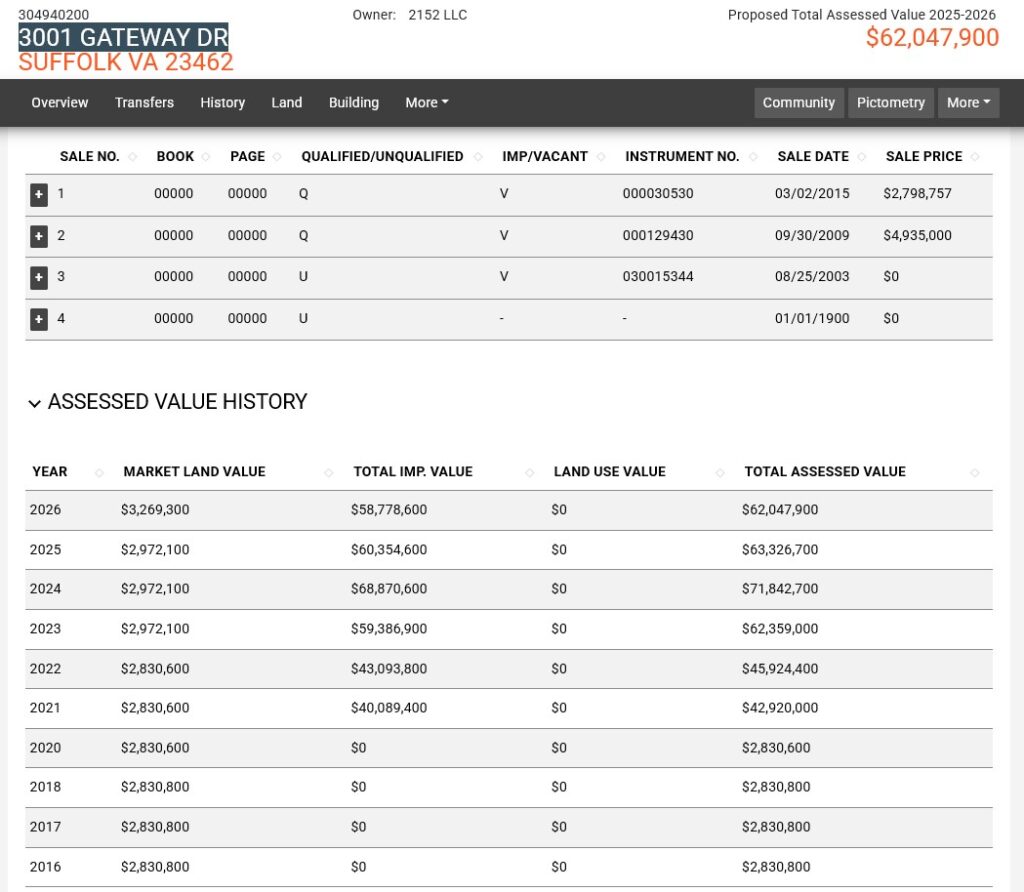

3001 Gateway Dr (Clairmont at Harbor View)

This is another apartment development that has seen its taxes decrease over the last 3 years from a high of $71.8M (2024), down to $63.3M (2025), with a further decrease down to $62M (2026).

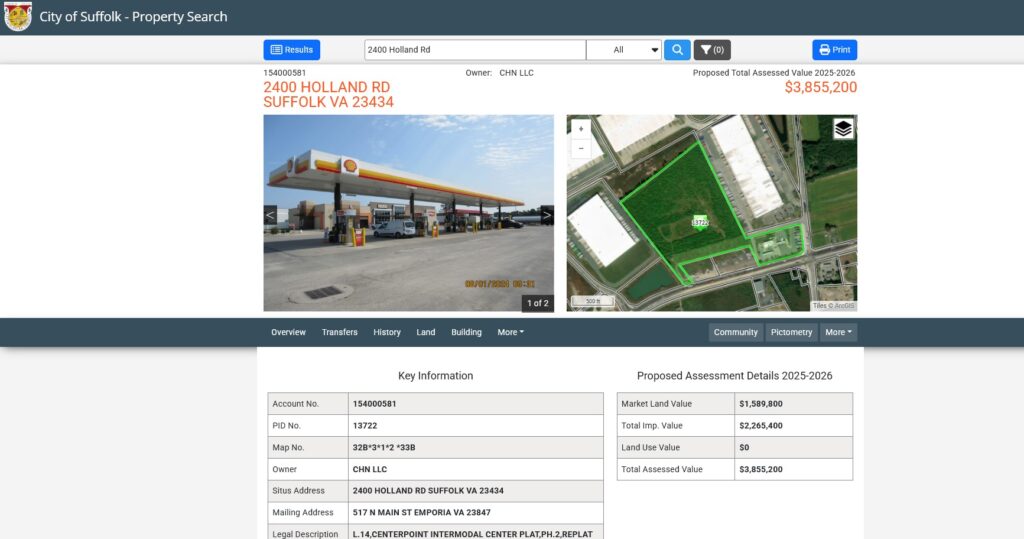

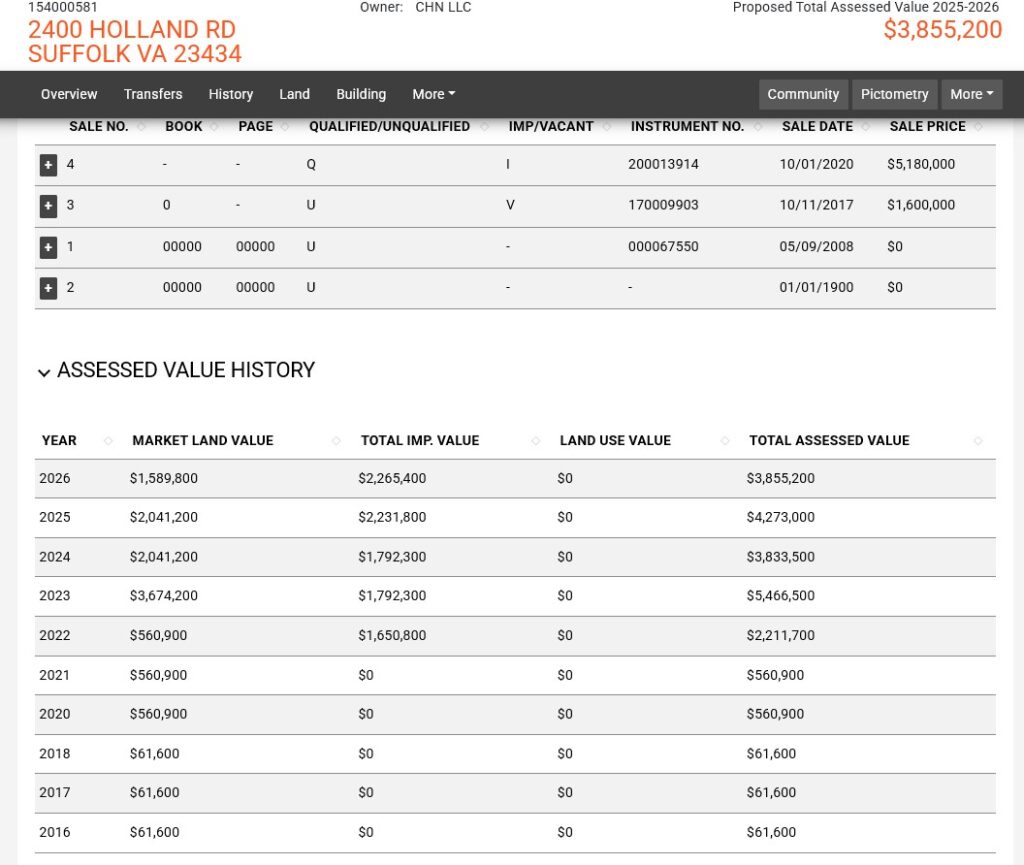

2400 Holland Rd (Shell & Pilot station)

This truck stop on Rt. 58 has an assessment of $3.86M (2026), down from a peak assessment of $5.5M (2023). It sold for $5.2M back in 2020. Its land value assessment has decreased considerably as well from a high of $3.7M (2023) to $1.6M (2026) for the 35.7 acres with frontage on Rt. 58.

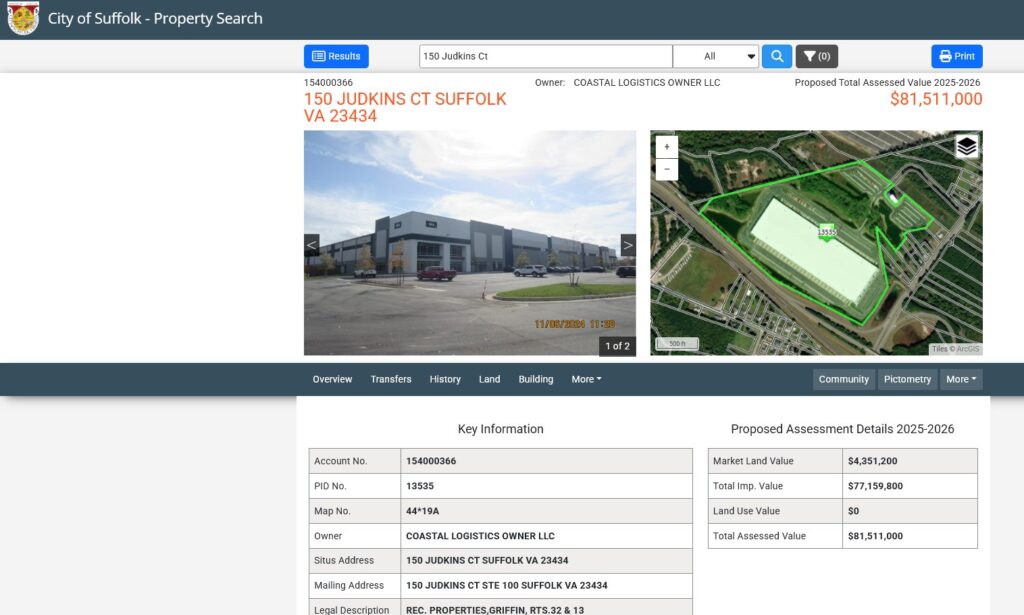

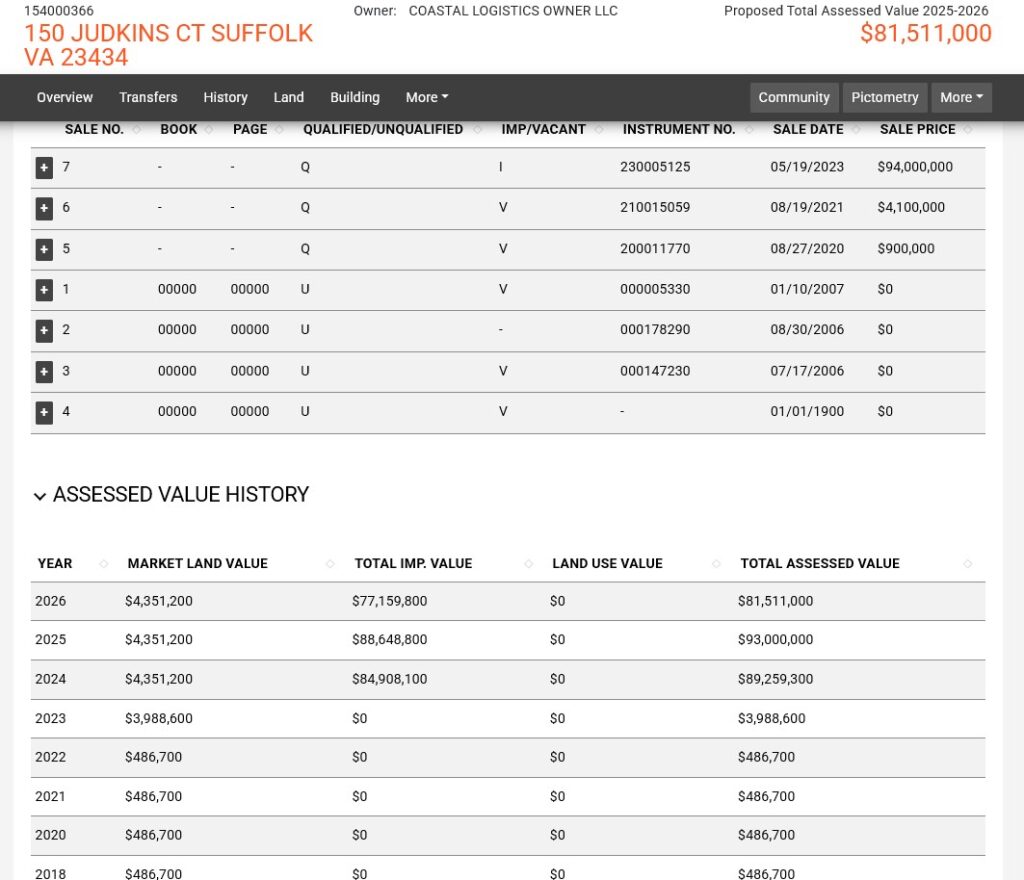

150 Judkins Ct

This warehouse is assessed at $81.5M (2026), down from $93M (2025) and $89.3M (2024). This is after its purchase price of $94M in 2023.

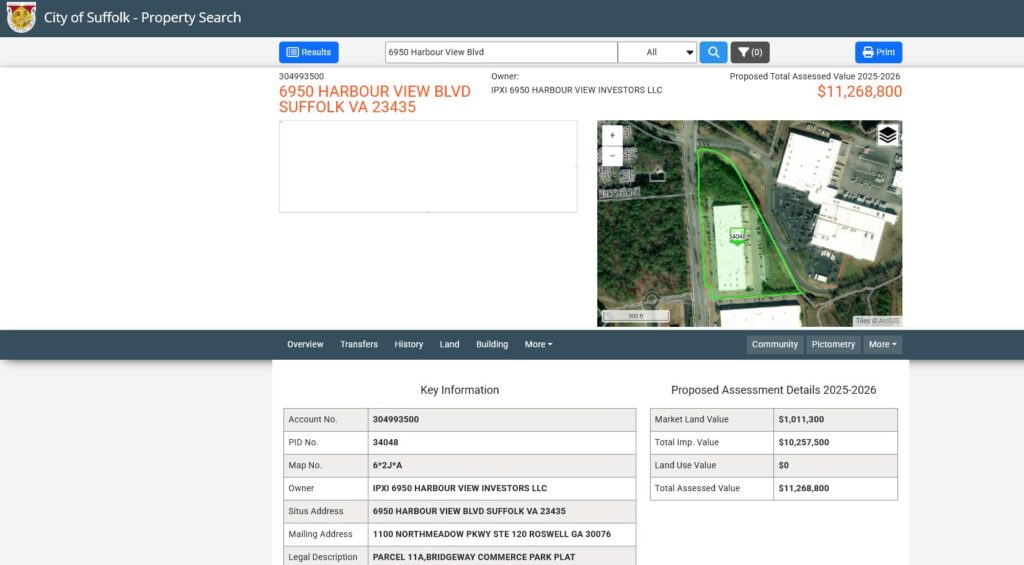

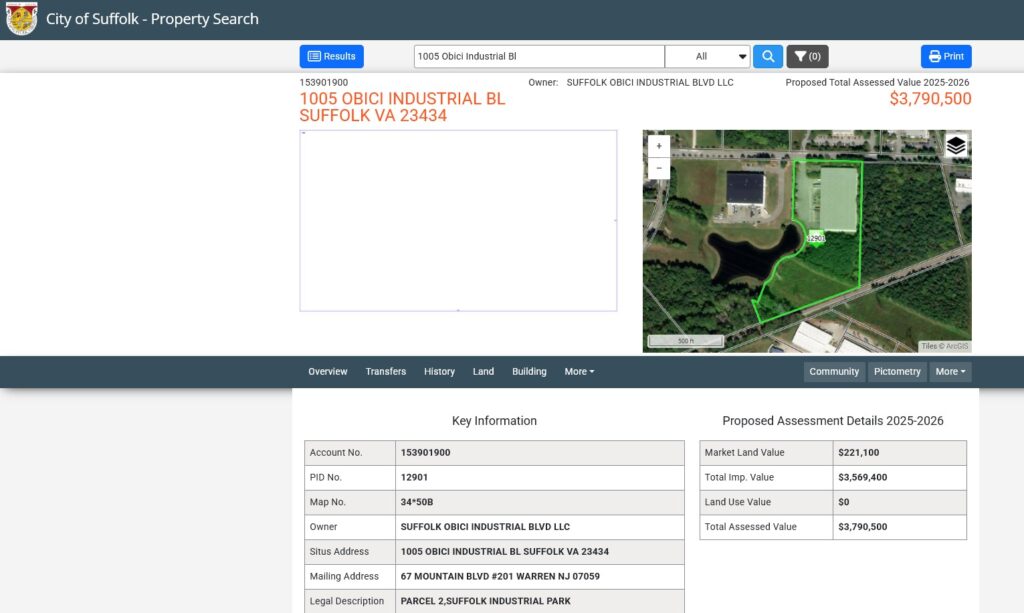

6950 Harbour View Blvd

Another warehouse, this one sold for $11.2M back in 2020, but was only assessed at $7M for the next few years (2020-2023) until its assessment was brought up to $11.2 value. Its land value of roughly $1M has remained relatively unchanged for the last decade.

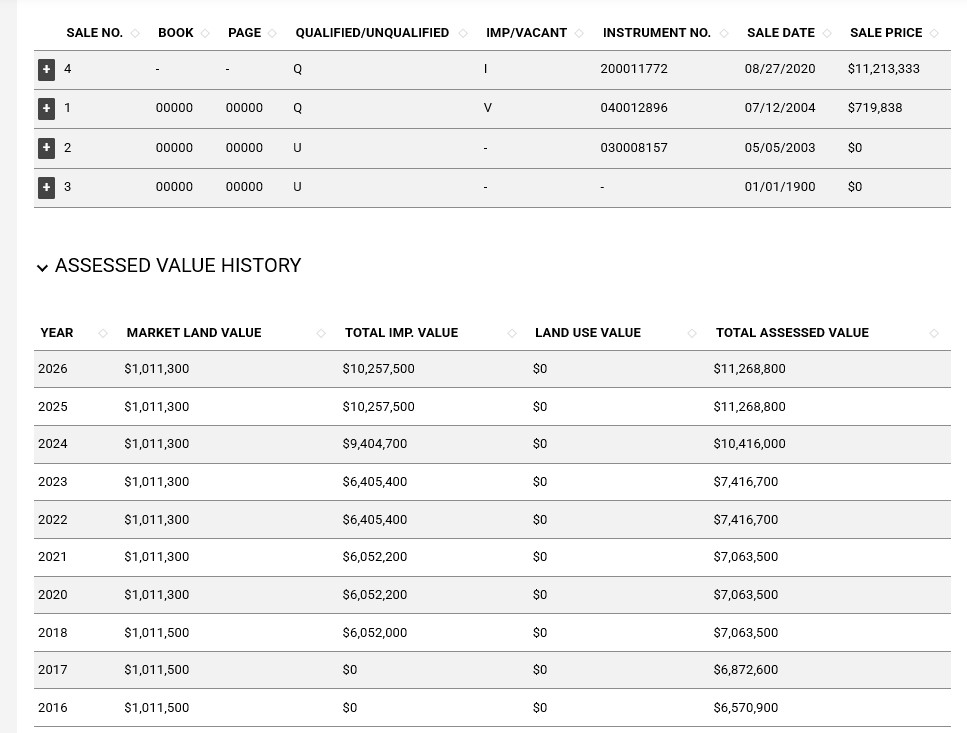

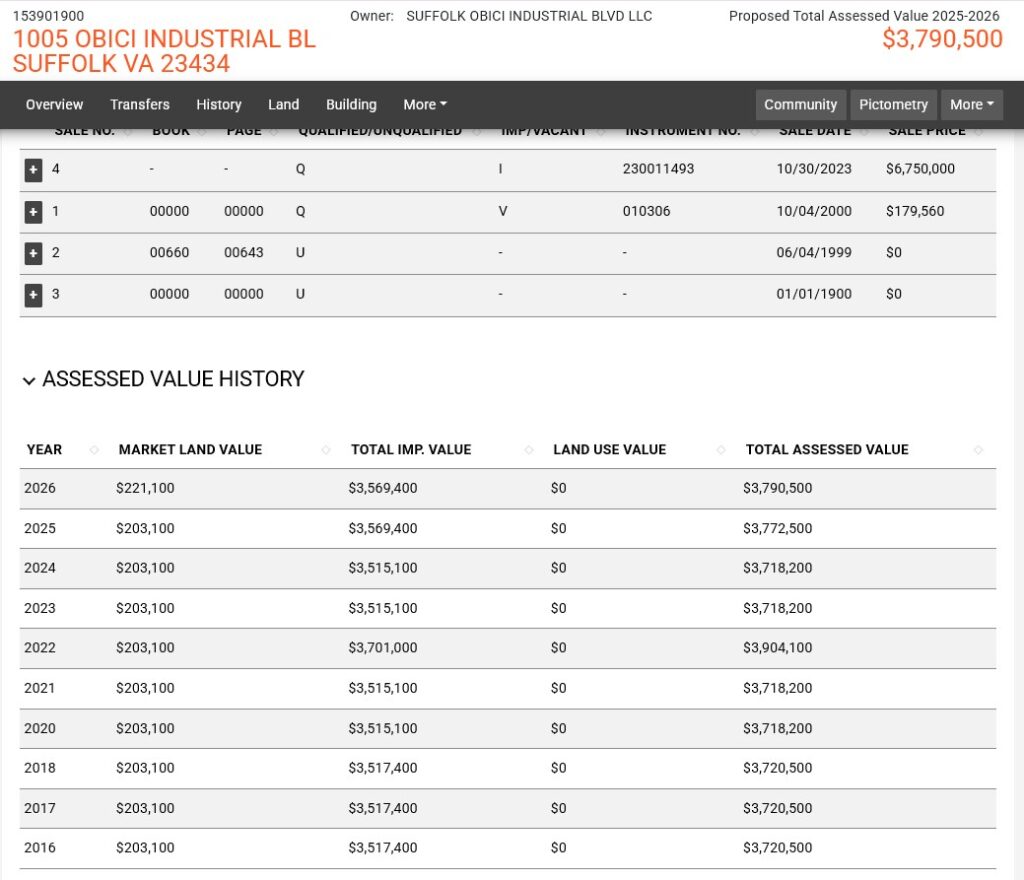

1005 Obici Industrial Blvd

This warehouse sold in 2023 for $6.75M, yet a couple years later it is still assessed at about $3.8M, far below fair market value.

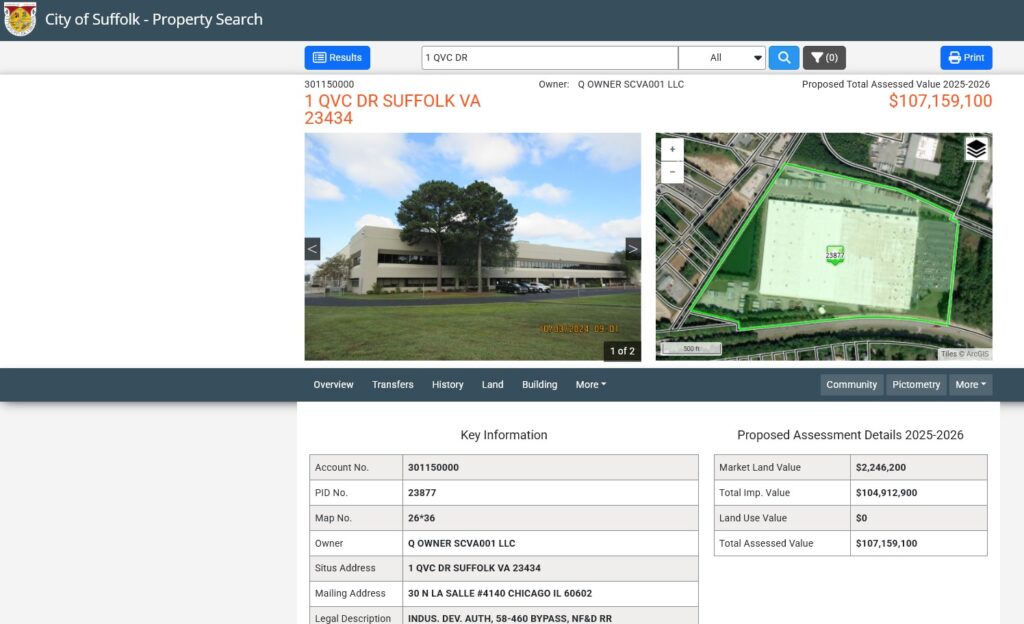

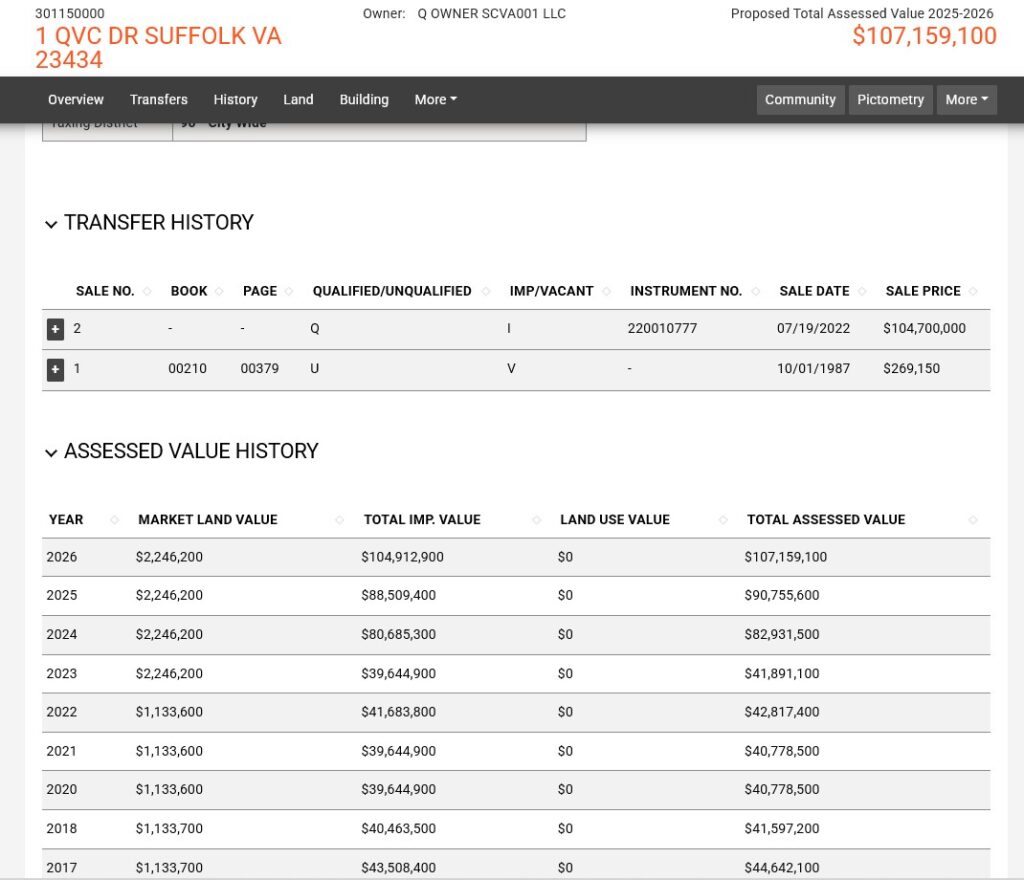

1 QVC Dr

This warehouse sold in 2022 for $104.7M and is currently assessed at $107M (2026). However, in 2023, a year after the sale, it was only assessed at $42M. It increased to $83M (2024) and then $91M (2025), but those are three years of being assessed substantially under fair market value by $62M (2023), $22M (2024), and $14M (2025). That is a total of $98M in under-assessments totaling over $1M less in taxes paid.

We see this trend downtown as well.

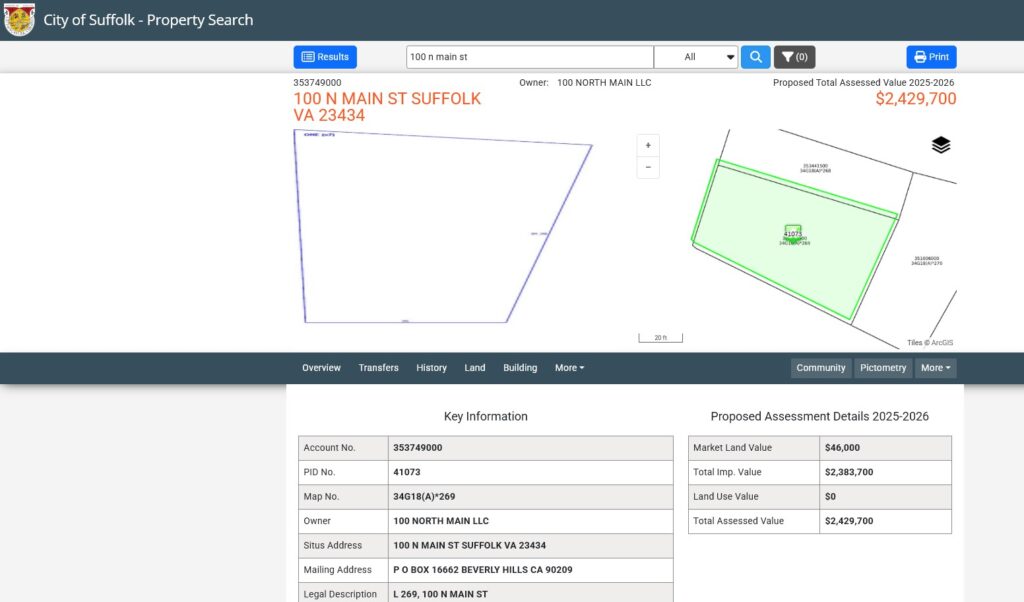

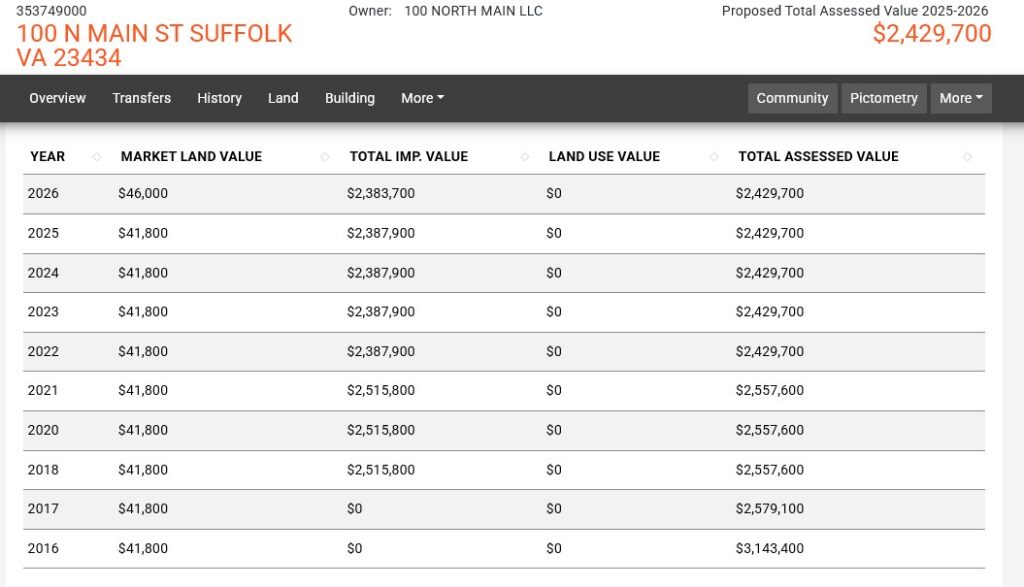

100 N Main St

The seven-story professional office building at the corner of Main St & Washington St – the heart of the city – has maintained the same $2.4M assessment from 2022 to the present. Before that it was actually higher at $2.6M.

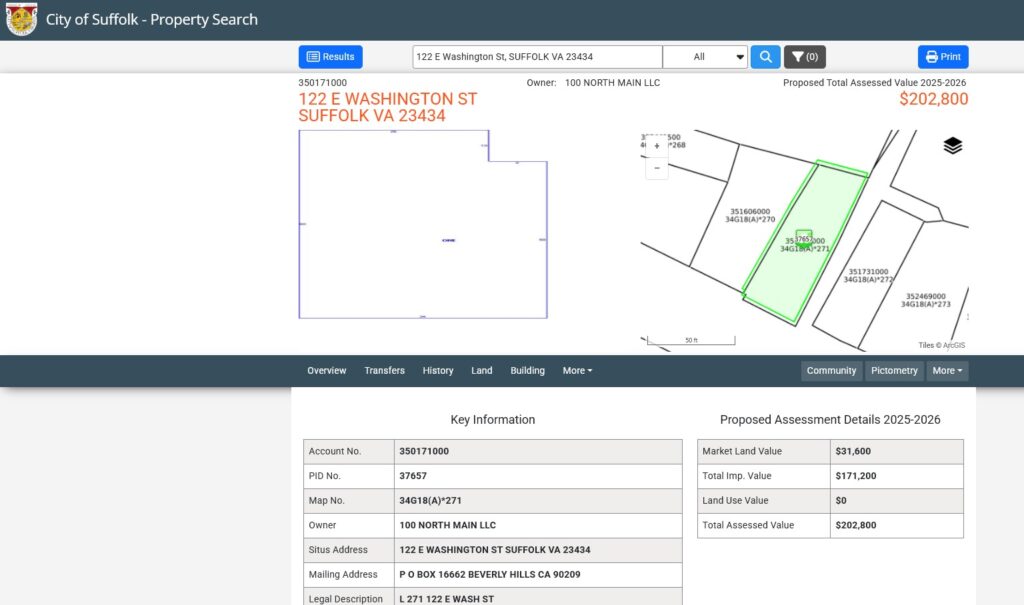

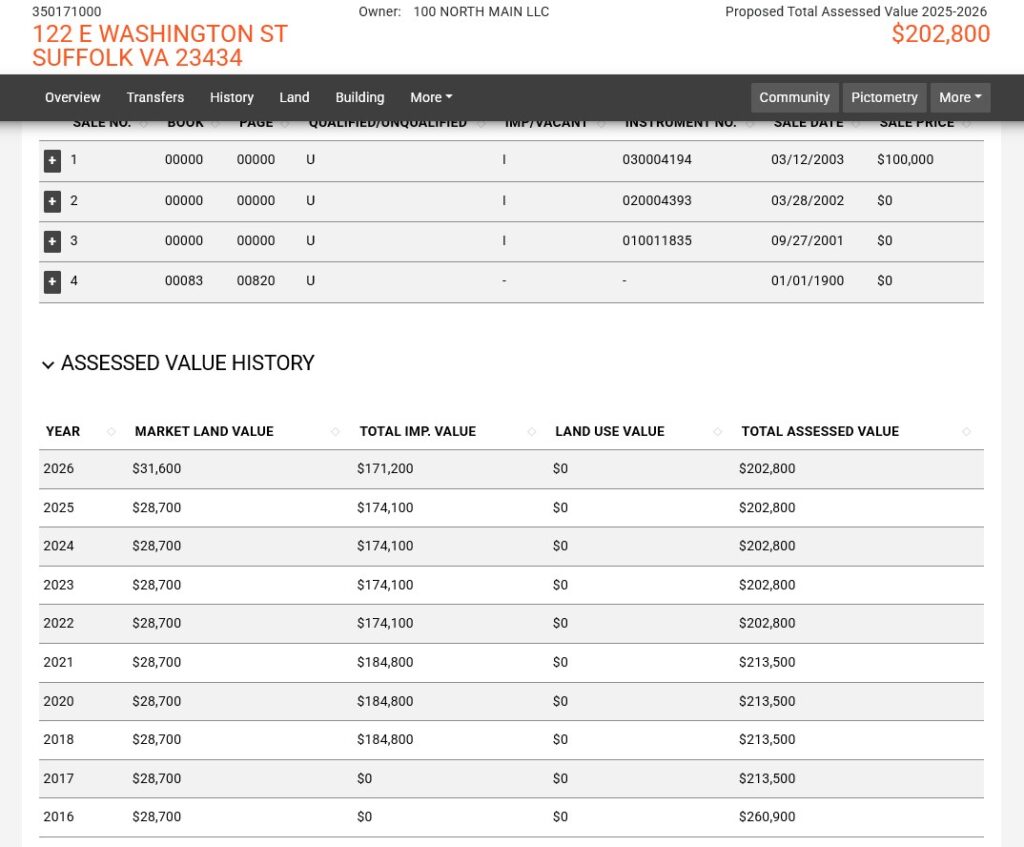

122 E Washington St

This downtown address has maintained its assessment of about $2M for five years running, which is down from a $2.1M assessment the four preceding years.

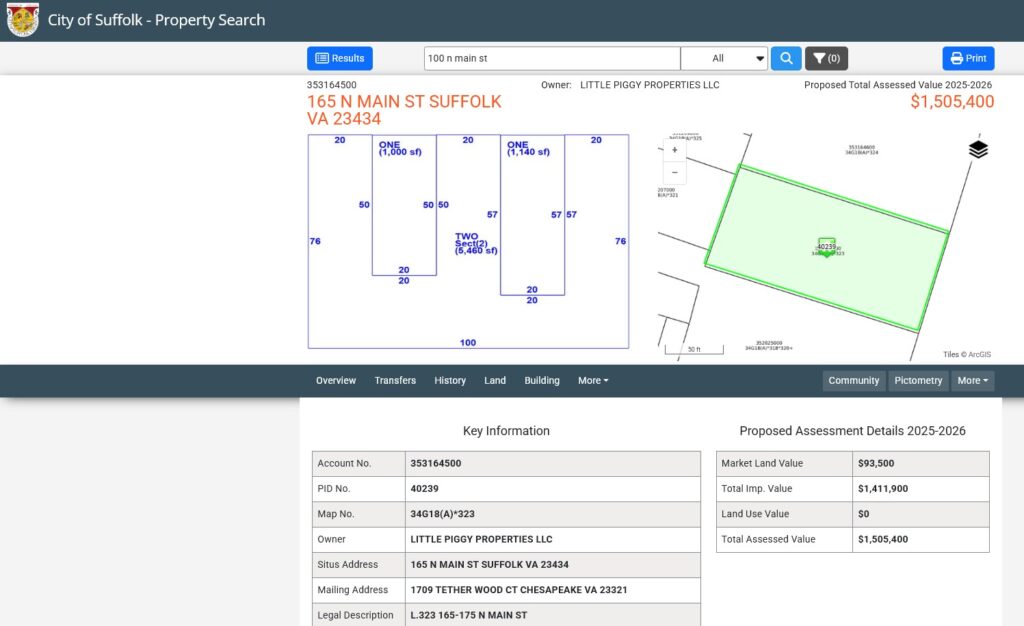

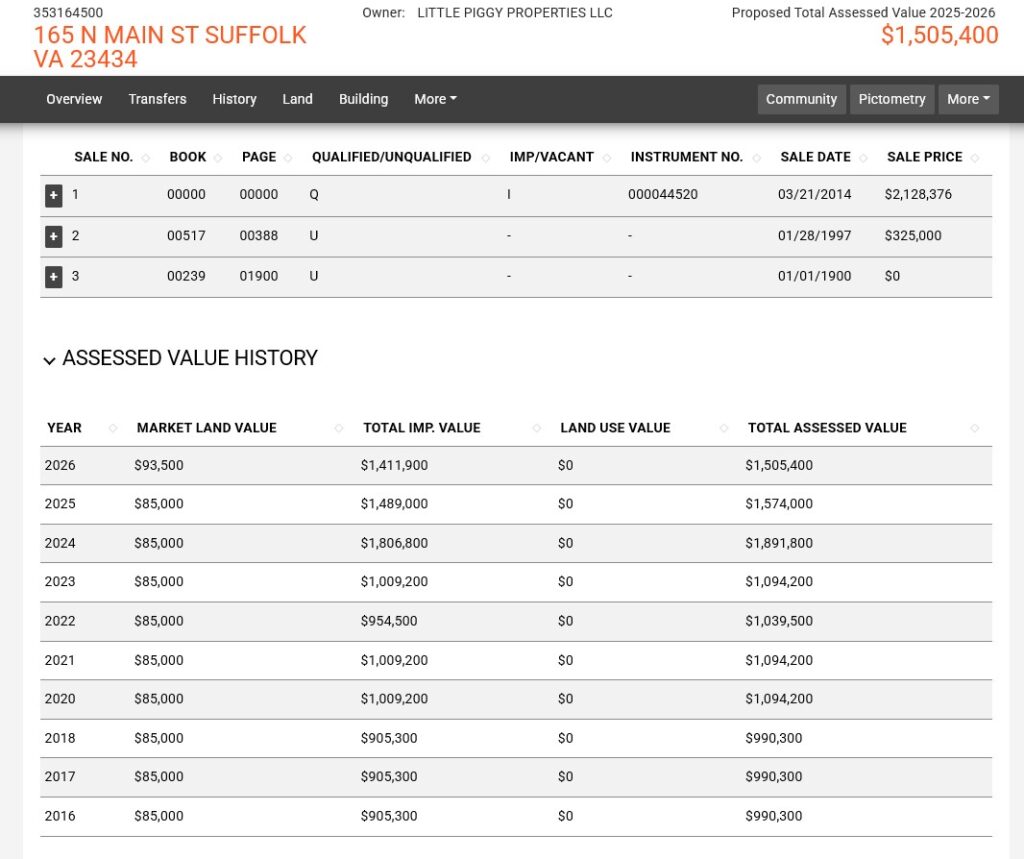

165 N Main St

This property is described as mixed retail with residential units. Its highest assessment was in 2024 at $1.9M, even though it sold for $2.1M back in 2014. Its assessment hovered around the $1M mark from 2016-2023 and recently has been assessed at about $1.5M for 2025 and 2026.

How many homeowners do we have out there that have been as lucky as these property owners? How many Suffolk residents have seen their assessments either go down or remained the same for several years in a row? The City seems to be very focused on squeezing every dollar out of residential properties – we see this in new assessments each year.

Why are they NOT this focused on commercial properties? Tax revenue is usually a main justification for approving rezonings for these types of higher intensity developments. It is the City’s duty to ensure that these businesses are paying their fair share of taxes.

If you decide to speak at the public hearing on Wednesday, May 7th at 6pm, consider letting City Council know how you feel about this.

The source for all this information comes from: https://property.spatialest.com/va/suffolk#/ ,which is a website that shows all the public data on property assessments for the last ten years. This is all public information.

The Virginia State Code requires that assessments be based on ‘fair market value’. Sale of a property establishes a fair market value (what a person pays for a property, who does not have to buy, but chooses to, from a person who does not have to sell, but chooses to).

my questions are… Who owns these properties? What kind of deal was cut and why?

That’s a great questions! Unfortunately, we don’t have any answers for that. There are so many businesses, literally hundreds, that have their property assessments that are significantly less than previous sales, or they have been flat for years, or in some cases, they have reduced assessments. Their assessments have been going down while the residents have been experience year after year of increases. It isn’t just one business or a few that are seeing these beneficial assessments, it is very wide spread. At the very least it is clear the city would rather focus its efforts on reassessing residents than focus on businesses.

Thank you Erin and Ann for researching and sharing this data with us. My assessment increased 11% this year. And, FWIW, the “Market Land Value for all the residential lakefront lots on Lake Meade increased 20%.

My assessment on my home went up 19.2 percent this year.

That is crazy! Almost 20% in one year is ridiculous. I’m sorry. Have you talked to the assessor’s office? Phone: 757-514-7475.